Turn 1p into £1 million in 28 days...

It’s February. You’re offered a job. The starting salary is 1p, but it will double each day until the end of the month – do you take the job? If you do, that would be a pretty smart move – by the end of the month your salary would be £1,342,177 or £2,684,354 if it’s a Leap Year!

Now, we admit, this isn’t a very life-like example, but it does show the power of something that Albert Einstein reputedly called the ‘eighth wonder of the world’: compound returns.

Here’s how it can play a big part in helping to grow your DC savings:

Embrace the 'snowball' effect

Compound returns is a process by which your investments earn money (hopefully) over time and those investment returns go on to earn more money, and so on and so on. A bit like a snowball that starts off small and builds on itself, getting bigger and bigger as it rolls.

Time is the key

Starting early unlocks the full benefits of compound returns. A little bit invested today will build up over time – so the more you put in now, the more you’ll have for the future. (The same with that snowball – the longer the hill it rolls down, the bigger it should be by the time it gets to the bottom.)

Here’s a more realistic example...

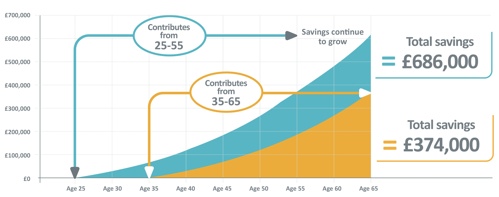

Take 2 members: they each pay in the same amount for the same amount of time (30 years). The only difference is one of them starts at 25 and the other starts at 35. If their investments grew by 5% a year until age 65, the outcome would be quite different, even though they paid in the same amount.

The member who started contributing at age 25 would have built up about £686,000, while the member who started at age 35, would have built up about £374,000.

The difference is because the member who started contributing at 25 gave their savings 10 more years to grow. Pretty impressive!

What we've assumed: pensionable earnings are £36,000 a year; both members contribute at 6% with 9% from ITV; so, £450 would be paid in each month (£300 by ITV and £150 by the member, although the actual cost to the member after tax relief (assuming they're a basic-rate tax payer) would be about £122 a month); both members contribute for 30 years, one from age 25 to 55 and the other from age 35 to 65; and investments grow by 5% a year until age 65.

Please note, external links and content are selected and reviewed when the page is published. However, the Trustee and WTW are not responsible for the content of external websites.

More quick reads to boost your knowledge:

What can sharks and toasters teach us about investing?

Think you understand risk? This may make you think differently!

What's inflation got to do with my savings?

Tips to help manage the effects of inflation on your savings